Personal finance has never been my forte. Nor Ed’s. In fact, when we moved some savings around to pay taxes and make IRA contributions this January, a bank officer suggested a different kind of account and Ed said, “Ask Martha. She’s the one who keeps track of that stuff.”

That was news to me.

Considering how much I know about investments, I figured having me in charge was only marginally better than relying on Bernie Madoff. So I decided it was high time I learned more.

I know a few things about economics — especially about economic history. I know about the gilded age and the robber barons; about T.R. and trust-busting; and about F.D.R. and the WPA. I also know some of the basic theories put forth by the likes of John Locke, Adam Smith, Thomas Malthus, Alexander Hamilton, Karl Marx, J.M. Keynes, and Milton Friedman. But I can’t say I found their ideas riveting.

And I still don’t know a mid-cap from a mad-cap, or what black swans have to do with anything. But I thought it should be fairly easy to learn — until I looked into it.

Recently I picked up a half dozen fairly new books on the subject at the library, but they were all full of incomprehensible terms, and their glossaries were awful. For example, the glossary of Panic: The Story of Modern Financial Insanity defines an M-LEC as: “(Master-Liquidity Enhancement Conduit). A $100 billion buyer of last resort for SIVs …” Which sent me to the entry for “Structured Investment Vehicle (SIV). An SIV is an entity that sells short-term commercial paper …” Which sent me to the entry for “Commercial paper …”

Thus far, I’ve read several glossaries in full, but haven’t finished any of those books. I’ve also watched numerous documentaries, and started reading and watching market news … But the only thing I know for sure thus far is that ignorance about financial matters is common.

In the last few months, I’ve seen televised reports of people making runs on FDIC-insured banks that failed. Why they were in such a hurry, I know not, since those banks were insured. But I’ve seen even more people (some of whom seem to have incomprehensibly gotten rich despite their ignorance) in tears because they had believed their stocks, bonds, mutual funds, hedge funds, annuities, and 401Ks were federally insured.

Lately, cable news programs have started offering emergency investment advice, and one oft repeated caution floored me. Nine News, CNBC, Fox, and Suze Orman have all told people to ask their banks and investment counselors about what is and isn’t insured — because, as it turns out, tens of thousands of investors in the U.S. who had invested huge sums of money had never bothered to consider the risks (or to even ask whether their deposits were insured or not).

I, on the other hand, have always asked. In fact, in January I asked my banker if, as had been reported, FDIC insurance coverage had been raised to cover up to $250,000 on my deposits, and whether that meant all together, or $250,000 for each account, including checking, savings, bank money market, IRAs, and CDs, and how that insurance applied for jointly held accounts.

And the woman at the bank was very nice and answered all of my questions — even if she did think my concerns were preposterous — since the old $100,000 limit was more than adequate for our needs. But you never know when I might suddenly make several hundred thousand dollars. So I asked, just in case.

And yet thousands of people who had somehow acquired hundreds upon hundreds of thousands of dollars apparently didn’t ask — until after it was gone.

According to Niall Ferguson, author of The Ascent of Money: “It is a well-established fact, after all, that a substantial proportion of the general public in the English-speaking world is ignorant of finance. According to a 2007 survey, four in ten American credit card holders do not pay the full amount due every month on the card they use most often … Nearly a third (29%) said they had no idea what the interest rate on their card was. Another 30 per cent claimed that it was below 10 per cent, when in reality the overwhelming majority of card companies charge substantially in excess of 10 per cent … A 2008 survey revealed that two thirds of Americans did not understand how compound interest worked … Less that 23 per cent knew that income tax is charged on the interest earned from a savings account if the account holder’s income is high enough. Fully 59 percent did not know the difference between a company pension, Social Security and a 401(k) plan …”

Ferguson concludes, “It seems reasonable to assume that only a handful of those polled would have been able to explain the difference between a ‘put’ and a ‘call’ option, for example, much less the difference between a CDO and a CDS.”

I’ve got to admit I got bogged down trying to understand the 1608 market for VOC stock and decided to give Ferguson’s book a rest. So I still don’t know much about put and call options or CDOs, but his book cheered me up considerably. It is always nice to know that you’re not alone in your ignorance.

I guess understanding this finance business is going to take a little longer than I expected. But despite my uncertainty about what Laffer curves and LIBOR reports are good for, I’ve learned a lot. First and foremost, I’ve realized that we ignorant types know more than Wall Street gives us credit for.

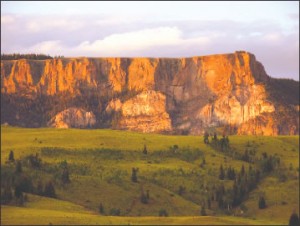

In Central Colorado, we intuitively understood that getting and spending more and more was not wise. Out here, people have been hosting energy fairs and sustainability forums and dreaming of a better day when Americans spend less to live better for many years.

Out here, we also knew that getting more stuff was not as important as knowing that what you have is safe and secure.

And despite Wall Street’s apparent surprise, we also knew that America’s economy was in trouble.

In Chaffee, Saguache, Alamosa, Rio Grande and many other rural Colorado counties, average family incomes are substantially below state and national averages. Thus, even when the Dow Jones was at 14,000, America’s economy had many of us in rural Colorado (especially those with medical problems, or kids with special needs, or property damaged by accidents, weather or decades of wear) running like hamsters on a wheel — working harder and harder just to stay in place.

All across the country, Americans who relied on small businesses, hourly wages and hard work for their livelihood were falling behind. Why? Because Alan Greenspan and other financial gurus believed that low wages would boost national prosperity. And until recently that plan delivered — for those who relied on investments, interest, stock options and benefit packages rather than jobs to finance their futures.

According to Greenspan, reducing our share of the pie was fair because it was good for America. And before long, other financial geniuses decided it was okay to bust unions, send our jobs overseas, borrow money from China, sell shoddy merchandise, talk people into lousy mortgages, repackage bad loans — and sometimes cheat us outright.

And that seems to be the biggest difference between modern financial wizards and the rest of us: How many of us would be eager to take advantage of widows, orphans, and returning warriors, construction workers, waitresses, and first-time home buyers in order to put their money into our bank accounts?

Not many, I suspect.

Martha Quillen is the former co-editor of Colorado Central Magazine who, though she continues her studies in economics, assumes she will always be poor, so doesn’t really see the point.